https://www.rrfinance.com/OurP....roducts/fixed-deposi

Explore the Best Fixed Deposit Schemes with Attractive Interest Rates

Introduction

Fixed deposits remain indispensable for risk-averse investors. By comparing bank and NBFC rates, choosing the right tenure, and leveraging compounding, one can secure steady returns. Whether it’s SBI’s stability, Bajaj Finance’s high returns, or tax-saving schemes, there is an FD for every financial goal. Investors should align FD selection with their liquidity needs and overall financial portfolio. For maximum benefit, it is wise to diversify across banks and NBFCs, ensuring both safety and higher yields. In 2025, with FD interest rates touching record highs, the time is opportune to lock in attractive rates for the future.

Why Fixed Deposits Remain a Timeless Choice

Fixed deposits are woven into the fabric of Indian savings culture. They provide stability, predictable income, and flexible tenure, making them suitable for salaried individuals, retirees, and even NRIs.

How Fixed Deposits Function

An FD involves depositing a lump sum with a bank or NBFC for a specific tenure at a pre-agreed interest rate. At maturity, the investor receives both the principal and accumulated interest, either simple or compounded.

Key Features of Fixed Deposit Accounts

• Guaranteed returns

• Tenure ranging from 7 days to 10 years

• Flexible payout options (monthly, quarterly, annually)

• Premature withdrawal facility (with penalties)

• Loan against FD availability

The Role of Interest Rates in FD Investments

The interest rate is the heart of a fixed deposit. Even a small difference in rates can impact long-term wealth accumulation. Hence, investors often compare multiple banks and NBFCs before locking in funds.

Current FD Interest Rate Trends in India (2025)

With inflationary pressures and global monetary shifts, FD rates in India have climbed compared to earlier years. Most banks now offer between 6.5% to 8%, while NBFCs and corporate deposits go as high as 8.5% to 9%.

Types of Fixed Deposit Schemes in India

1. Regular Fixed Deposits

A standard deposit with fixed tenure and interest rate—ideal for conservative investors.

2. Tax-Saving Fixed Deposits (Section 80C)

A 5-year lock-in deposit eligible for tax deduction up to ₹1.5 lakh annually.

3. Senior Citizen Fixed Deposits

Offer an additional 0.25%–0.75% interest, ensuring retirees earn higher returns.

4. Flexi Fixed Deposits

A hybrid product linking FDs with savings accounts for liquidity and better returns.

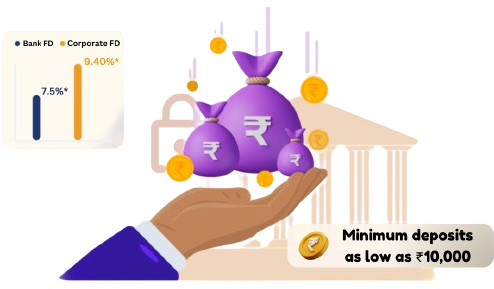

5. Corporate Fixed Deposits

Offered by NBFCs and corporates, these provide higher rates but require careful risk evaluation.

6. NRI Fixed Deposits

• NRE FD – Interest tax-free in India, repatriable.

• NRO FD – Interest taxable in India.

• FCNR FD – Held in foreign currency, protecting against exchange rate risk.

Benefits of Choosing Fixed Deposits

• Capital safety

• Guaranteed interest returns

• Flexible investment options

• Easy to open and manage online

• Can be used as collateral for loans

Limitations of Fixed Deposits

• Lower returns compared to equity-linked products

• Interest is fully taxable

• Inflation may reduce real value of returns

• Penalties for premature withdrawal

Best FD Interest Rates in India – Top Banks 2025

• State Bank of India (SBI): 6.8% – 7.5%

• HDFC Bank: 7.0% – 7.75%

• ICICI Bank: 7.1% – 7.8%

• Axis Bank: 7.25% – 7.9%

• Bank of Baroda: 6.85% – 7.65%

Best NBFC Fixed Deposit Schemes 2025

• Bajaj Finance FD: Up to 8.6%

• Mahindra Finance FD: Up to 8.4%

• Shriram Finance FD: Up to 8.75%

• PNB Housing FD: Around 8.25%

Comparison: Bank FD vs NBFC FD

• Bank FD: Safer, insured up to ₹5 lakh by DICGC

• NBFC FD: Higher interest, slightly higher risk, not insured

Strategies to Maximize FD Returns

• Laddering deposits across multiple maturities

• Choosing cumulative option for compounding

• Comparing rates across institutions before investing

• Opting for NBFC FDs for short to medium tenures

Premature Withdrawal Rules and Penalties

Breaking an FD early attracts a penalty of 0.5%–1% on the applicable rate. Strategic tenure planning helps avoid this loss.

Loan against Fixed Deposit Facility

Investors can borrow up to 90% of the FD value without breaking it. Interest rates on such loans are 1–2% above the FD rate, making it a cost-effective credit option.

Tax Implications of Fixed Deposits

• Interest is fully taxable under “Income from Other Sources.”

• TDS applicable if annual interest exceeds ₹40,000 (₹50,000 for senior citizens).

• Tax-saving FDs eligible for deduction under Section 80C.

How Inflation Impacts FD Returns

While FDs offer fixed nominal returns, inflation erodes their purchasing power. Investors must balance FDs with inflation-beating instruments like mutual funds or bonds.

Digital Transformation in FD Investments

From e-FDs to mobile banking apps, investors can now:

• Open FDs instantly online

• Track interest accrual

• Renew or close deposits digitally

• Receive maturity payouts directly into accounts

Safety of Fixed Deposits – Deposit Insurance Coverage

Deposits in scheduled banks are insured up to ₹5 lakh per depositor under DICGC. This strengthens the safety net for small and medium investors.

Frequently Asked Questions (FAQs)

1. Which bank gives the highest FD interest rate in 2025?

Private Banks like Axis and ICICI offer up to 7.9%, while NBFCs like Shriram Finance offer 8.75%.

2. Are NBFC fixed deposits safe?

We offer higher returns but carry slightly more risk. Investors should check credit ratings before investing.

3. Can I break my FD before maturity?

Yes, but penalties apply. Some banks offer partial withdrawal facilities.

4. Is FD interest taxable in 2025?

Yes, except for interest earned on NRE FDs. Tax-saving FDs are exempt under Section 80C up to ₹1.5 lakh.

5. What is the maximum FD insurance cover in India?

₹5 lakh per depositor per bank under DICGC.

Conclusion – Best FD Schemes for 2025

Fixed deposits remain indispensable for risk-averse investors. By comparing bank and NBFC rates, choosing the right tenure, and leveraging compounding, one can secure steady returns. Whether it’s SBI’s stability, Bajaj Finance’s high returns, or tax-saving schemes, there is an FD for every financial goal.

🔗 You May Also Like

• SIP & Mutual Funds in 2025 – The Smart Way to Build Wealth in India

• How RBI Floating Rate Savings Bonds Are Better Than Fixed Deposits

• How to Invest in Capital Gain Bonds Online in 2025

RR Finance

https://www.rrfinance.com/OurP....roducts/MutualFund/b

Investing in mutual funds through a Systematic Investment Plan (SIP) is one of the simplest and safest ways to grow your money in 2025. By making small, regular contributions, you can steadily build your wealth, save on taxes, and achieve your financial goals, one step at a time.

Why Indians Are Choosing Mutual Funds

These days, more and more Indians are embracing mutual funds and SIPs (Systematic Investment Plans) because they tend to provide better returns compared to traditional savings options like fixed deposits or recurring deposits. Thanks to increasing financial literacy and the rise of digital apps, investing has become easier, faster, and more transparent than ever.

What is a Mutual Fund?

A mutual fund collects money from many investors and invests it in different places — like shares, bonds, or government securities. This helps you earn good returns without needing expert knowledge.

Your money is managed by a professional fund manager who studies the market and decides where to invest. This way, you benefit from their experience.

How Does a Mutual Fund Work?

When you invest in a mutual fund, you get units based on the amount you invest. The price of these units is called NAV (Net Asset Value). If the fund performs well, your NAV increases, and so does your wealth.

Because mutual funds invest in many different sectors, your money is safer compared to investing in just one stock.

Types of Mutual Funds in India

a. Equity Funds

Invest mainly in company shares. Suitable for long-term goals like retirement or child’s education.

b. Debt Funds

Invest in bonds and government securities. Best for those who want stable and safe returns.

c. Hybrid Funds

A mix of equity and debt — giving you growth as well as safety.

d. Index Funds

Follow popular market indexes like Nifty 50 or Sensex. They are low-cost and good for beginners.

Sectorial Funds

Focus on one industry like IT, banking, or healthcare. These can give high returns but are a bit riskier.

What is SIP (Systematic Investment Plan)?

A SIP allows you to invest a fixed amount (for example ₹500 or ₹100 every month in a mutual fund. It’s like a recurring deposit, but with much better potential returns.

SIP is the easiest way to invest regularly without worrying about market ups and downs.

Benefits of SIP

Start small: Begin with ₹500 per month.

No need to time the market: You invest regularly, no matter the market condition.

Rupee cost averaging: You buy more units when prices are low, fewer when prices are high.

Power of compounding: Your returns earn more returns over time.

Flexibility: You can start, pause, or stop anytime.

Power of Compounding Explained

Compounding means your money grows faster because you earn returns not only on your original investment but also on the returns it generates.

Example: If you invest ₹5,000 every month for 20 years at 12% return, you could build over ₹49 lakh — even though you invested only ₹12 lakh!

SIP vs. Lump Sum Investment

If you invest a big amount at once, it’s called a lump-sum investment.

If you invest smaller amounts regularly, it’s a SIP.

For most Indians, SIP is better because you don’t need to worry about market timing. It builds wealth slowly but steadily.

Why Mutual Funds Are Good for Indian Investors

• You can start with very little money.

• You get professional fund management.

• You can withdraw anytime (except tax-saving funds).

• You can track your money online anytime.

Mutual funds are transparent, regulated by SEBI, and suitable for all age groups.

Tax Benefits of Mutual Funds

If you invest in ELSS (Equity Linked Savings Scheme) through SIP, you can save tax under Section 80C up to ₹1.5 lakh per year.

Other mutual funds also offer long-term capital gains, which are taxed at lower rates.

How to Start a SIP in India

Starting a SIP is simple:

1. Choose a trusted platform like RR Finance.

2. Complete you’re KYC (it takes a few minutes online).

3. Select a mutual fund scheme based on your goal.

4. Decide the monthly amount and date.

5. Sit back and let your money grow.

💡 Tip: The earlier you start, the more you benefit from compounding.

How to Choose the Right Mutual Fund

• Define your goal (short-term or long-term).

• Check the fund’s 3–5 year performance.

• See the expense ratio and fund manager’s record.

• Compare returns with benchmark indices.

Common Mistakes to Avoid in SIP

Stopping SIPs when the market falls.

Investing in too many funds.

Not reviewing your SIP once a year.

expecting quick returns

Remember, SIP is a long-term plan — patience pays!

Tracking Your SIP Performance

Use online tools or mobile apps to see how your investment is growing.

Focus on CAGR and XIRR (annual return rate) instead of daily changes.

Step-Up SIP – Increase as You Grow

You can increase your SIP amount every year by 10–15% as your salary increases. This small step can make a huge difference in your final wealth.

SIP in ELSS – Save Tax and Build Wealth

ELSS funds are the best tax-saving option under Section 80C. They have a 3-year lock-in period and invest mainly in equity. SIP in ELSS helps you save tax and grow wealth at the same time.

SIP for Different Goals

For Long-Term Goals

• Retirement

• Child’s higher education

• Buying a house

For Short-Term Goals

• Building an emergency fund

• Vacation planning

• Small savings for gadgets or gifts

Myths about SIP and Mutual Funds

SIP gives guaranteed returns – False (returns depend on market).

You need big money to start – False (start with ₹50.

Mutual funds are only for experts – False (anyone can invest).

The Future of Mutual Funds in India

The Indian mutual fund industry is growing fast. With more digital options, UPI payments, and awareness, even small investors from towns and villages are joining in.

By 2030, mutual funds are expected to become one of India’s top investment choices.

FAQs about SIP and Mutual Funds

1. What is SIP in mutual funds?

SIP lets you invest a small fixed amount every month in a mutual fund to build wealth over time.

2. Is SIP safe for beginners?

Yes. SIPs are perfect for beginners because they are simple, flexible, and help you avoid market timing.

3. How much can I start with?

You can start a SIP with as low as ₹500 per month.

4. Can I stop my SIP anytime?

Yes. SIPs are flexible — you can pause or stop them without penalty.

5. Are SIP returns taxable?

Yes. Returns depend on the type of fund. ELSS offers tax benefits, while other funds are taxed on gains.

________________________________________

💼 Start Your SIP Journey Today with RR Finance

Every small investment you make today can become a big achievement tomorrow. SIP is not just about saving — it’s about building a better future for you and your family.

At RR Finance, you can easily compare top mutual funds, calculate returns, and start your SIP online in minutes.

👉 Start your SIP today and move one step closer to your financial freedom.

________________________________________

🔗 You May Also Like

• How to Invest in Capital Gain Bonds Online in 2025

• Best Fixed Deposit Schemes in India

• How RBI Floating Rate Savings Bonds Are Better Than Fixed Deposits

https://www.rrfinance.com/OurP....roducts/RBI_Floating

RBI Floating Rate Bonds - Advantages & Interest Rate

Introduction to RBI Floating Rate Savings Bonds

RBI Floating Rate Savings Bonds 2020 (Taxable), also known as the GOI Bonds, currently offer a taxable interest rate of 8.05% (till 31st Dec 2025) over a seven-year term. They are called floating-rate bonds because the interest rate on these bonds is linked to the NSC rate. In accordance with the scheme guidelines issued on June 26, 2020, these floating rate bonds will continue to earn 0.35% higher ROI than the prevailing NSC rate. Coupon/Interest rate on these bonds is subject to change every six months, on January 1 and July 1, if NSC's ROI changes.

Historical Evolution of RBI Bonds in India

For many years, government-backed savings instruments have been available, giving everyday citizens a way to invest in the nation’s progress. In the past, options like RBI Relief Bonds and 8.05% Savings Bonds were quite popular. The launch of floating-rate bonds represented a significant change, allowing investors to benefit from interest rates that move with the economy instead of being stuck with fixed rates.

What Are Floating Rate Savings Bonds?

Floating Rate Savings Bonds are debt instruments issued directly by the Government of India through the RBI. Unlike fixed-rate bonds, their returns are tied to current market benchmarks. This means that investors earn a rate that reflects the present economic climate, striking a nice balance between predictability and flexibility.

Eligibility to Invest in RBI Bonds

Investment opportunities are available to Indian residents, Hindu Undivided Families (HUFs), and certain institutions. However, Non-Resident Indians (NRIs) are not allowed to participate. This focus ensures that the scheme primarily benefits local savers and retirees.

Key Features of RBI Floating Rate Savings Bonds

5.1 Tenure of Investment

These bonds come with a seven-year lock-in period, making them a medium to long-term investment option, perfect for those with stable investment goals.

5.2 Interest Rate Mechanism

The interest rate is adjusted every six months and is linked to the current National Savings Certificate (NSC) rate, plus an additional spread. This dynamic adjustment keeps the returns in line with the market, ensuring that investors are always getting a fair deal.

5.3 Taxation Rules

While the interest you earn is fully taxable, it comes with the peace of mind of being backed by the government. Just keep in mind that you'll need to factor in TDS (Tax Deducted at Source) when you're planning your annual income tax returns.

How the Interest Rate is Determined

The RBI sets the return based on the NSC rate plus a fixed margin, usually around 0.35% above that rate. This setup gives you a little extra cushion—investors can expect to earn slightly more than what traditional government-backed savings schemes offer.

Comparison with Fixed Deposits (FDs)

Unlike FDs, where your rate is locked in when you invest, floating rate bonds adjust their rates periodically. FDs might give you some predictability, but they come with the risk of having to reinvest at lower rates when they mature. On the other hand, RBI bonds automatically keep pace with market trends.

Comparison with Government Securities (G-Sacs)

G-Sacs can provide liquidity through trading, but they require a demat account and some active management. Floating Rate Savings Bonds make things easier by taking market volatility out of the equation while still offering the security of government backing.

Liquidity and Premature Withdrawal Conditions

If you need to withdraw early, there are restrictions. However, senior citizens get some special perks, with the lock-in period shortened based on their age (ranging from 4 to 6 years). For everyone else, the seven-year term is set in stone.

Safety and Risk Factors

These bonds come with zero credit risk since they’re issued by the Government of India. The only real risk is interest rate volatility—returns could dip if the economy enters a low-rate phase.

Advantage of Investing in RBI Floating Rate Savings Bonds

• Government-backed safety

• Returns linked to current rates

• More assurance than market-linked options

• Great for retirees looking for steady income

Limitations and Challenges for Investors

• Not tradable on stock exchanges

• Mandatory lock-in period limits liquidity

• Taxable interest can eat into your post-tax returns

• No option for joint holding with NRIs

Ideal Investor Profile for RBI Bonds

These bonds are a great fit for conservative investors, retirees, and families looking for steady, government-backed returns. If you value safety over chasing high yields, you’ll likely find these bonds quite attractive.

Application and Allotment Process

You can apply for these bonds through specific banks and the Stock Holding Corporation of India Limited (SHCIL). Instead of receiving physical certificates, investors get Bond Ledger Accounts (BLA), which makes keeping track of your investments much easier.

Digital and Offline Modes of Investment

Thanks to the rise of digital technology, the RBI now allows you to apply and make payments online through net banking. But don’t worry if you’re not tech-savvy—traditional offline applications are still available, making it easier for senior citizens to participate.

Impact of Inflation on Returns

Since the coupon resets every six months, these bonds might find it tough to keep up with inflation during periods of high inflation. Still, the government guarantee means your principal is safe from losing value.

Role in a Diversified Portfolio

While they shouldn’t make up your entire investment strategy, floating rate bonds can provide stability to your portfolio. They help balance out the risks associated with more volatile equity investments.

Future Outlook of RBI Floating Rate Bonds

As global interest rates face uncertainty, floating rate bonds could continue to act as a cushion against market fluctuations. Policymakers might also tweak their features to encourage more retail investors to get involved.

Expert Tips for Maximizing Returns

• Invest when interest rates are high to secure better returns

• Include them as part of your fixed-income strategy in retirement portfolios

• Pair them with tax-saving options to boost overall efficiency

Conclusion: Should You Invest?

RBI Floating Rate Savings Bonds offer security, reliability, and a government guarantee. While they may not be the most liquid or tax-efficient option, they’re a solid choice for those who prioritize safety. If you’re not one to take risks, these bonds could be just what you need.

🔗 You May Also Like

• SIP & Mutual Funds in 2025 – The Smart Way to Build Wealth in India

• Best Fixed Deposit Schemes in India

• How to Invest in Capital Gain Bonds Online in 2025

https://www.rrfinance.com/OurP....roducts/Invest_in_Ca

Capital Gain Bonds 2025 - Tax Savings with 54EC Bonds

Capital Gain Bonds, also known as 54EC Bonds, are a type of financial instrument issued under Section 54EC of the Income Tax Act, 1961. These bonds offer a tax-saving option for individuals who have earned long-term capital gains from the sale of their real estate property, such as land or buildings. By reinvesting their profits in bonds within 6 months of the sale of their property, investors can save on capital gains tax.

Capital Gain Bonds help an investor to avoid huge capital gains taxes on the sale of real estate. These bonds allow an investment of up to ₹50, 00,000 every financial year, providing a secure and stable investment option. It is also important to note that the principal amount invested will help in tax savings, but the interest earned on these bonds is taxable.

Understanding Capital Gain Bonds

1. Lock-in Period – It is very important to be aware of the lock-in period when you invest in 54EC Capital Gain Bonds. This period has a specific duration of 5 years, and during this, you cannot withdraw your invested funds. You can get back your original investment amount after the lock-in period ends without any fresh tax implications.

2. Eligibility – Any individual or Hindu Undivided Family (HUF) who has earned Long-Term Capital Gains from the sale of property or land is qualified to buy Capital Gain Bonds. Generally speaking, Long-Term Capital Gains are gains from assets you own for longer than a specific time frame, such as 12 months.

What Are Capital Gain Bonds?

Capital Gain Bonds, also called 54EC Bonds, are special debt instruments issued by government-backed entities such as:

• Housing and Urban Development Corporation(HUDCO)

• Rural Electrification Corporation Limited (REC)

• Power Finance Corporation Limited (PFC)

• Indian Railway Finance Corporation Limited (IRFC)

These bonds are designed to provide tax exemption on long-term capital gains arising from the sale of land, building, or both. By investing the eligible gains in these bonds, investors can avoid paying capital gains tax, subject to specific conditions.

Tax Benefits under Section 54EC

The primary attraction of Capital Gain Bonds is the complete exemption from long-term capital gains tax if:

• The investment is made within 6 months from the date of transfer of the asset.

• The amount invested is up to a maximum of ₹50 lakh in a financial year.

• The bonds are held for a lock-in period of 5 years.

If these conditions are met, the capital gain amount invested becomes fully tax-exempt.

Key Features of 54EC Bonds

Particulars Details

Issuer HUDCO, REC, PFC, IRFC

Eligibility Resident individuals, HUFs, companies, and others

Face Value ₹20,000 per bond

Maximum Investment ₹50 lakh in a financial year

Interest Rate Around 5.25% p.a. (taxable)

Lock-in Period 5 years

Taxation on Interest Interest is taxable as per investor's income slab

Mode of Holding Demat or physical certificate

Why Choose Capital Gain Bonds?

1. Tax Savings – Ideal for individuals looking to reinvest capital gains from property sales without paying hefty taxes.

2. Low Risk – Issued by government-backed entities, ensuring high credit safety.

3. Steady Returns – While interest rates are modest, they are stable over the tenure.

4. Hassle-Free Process – Simple application with minimal paperwork.

Example of Tax Saving

Suppose you sell a residential property and earn a long-term capital gain of ₹40 lakh. If you invest the entire amount in 54EC Bonds within 6 months, you can completely save the capital gains tax (which could be up to 20% + indexation). Your only taxable income from the bonds will be the annual interest received.

Points to Keep in Mind

• Partial investments will result in proportionate exemption.

• The bonds cannot be transferred, pledged, or sold before maturity.

• Interest from bonds is taxable and does not qualify for any further deduction.

• Application requires PAN, address proof, and a cheque/DD for the investment amount.

Pros and Cons of Capital Gain Bonds

Pros

• Full exemption from long-term capital gains tax.

• Backed by government entities, hence low credit risk.

• Fixed interest payout ensures predictable returns.

Cons

• Lock-in period of 5 years reduces liquidity.

• Interest rate (around 5.25%) is lower compared to other investment products.

• No benefit on interest income; it is fully taxable.

Comparison with Other Tax-Saving Options

• Real Estate Reinvestment (Section 54F): Requires reinvestment in another property, which may involve high costs and less flexibility.

• Mutual Funds / Equity: Potentially higher returns but subject to market risk and no assured tax exemption like 54EC bonds.

• Fixed Deposits: Offer higher liquidity and sometimes better rates, but do not provide capital gains tax exemption.

Thus, 54EC Bonds stand out when the main goal is capital gains tax exemption rather than wealth creation.

Frequently Asked Questions (FAQs)

Q1. Can NRIs invest in 54EC Bonds?

Yes, NRIs are eligible to invest in certain issues of capital gain bonds, subject to RBI approval.

Q2. Can I invest jointly with another person?

Yes, joint applications are allowed. However, the exemption is available only to the first holder.

Q3. What happens if I miss the 6-month window?

If you fail to invest within 6 months, you lose the benefit of tax exemption.

Q4. Can I invest in both REC and NHAI bonds in the same year?

Yes, you can split your investment across eligible issuers, provided the total does not exceed ₹50 lakh in a financial year.

________________________________________

How RR Finance Can Help You

At RR Finance Services Pvt Ltd, we simplify the process of investing in Capital Gain Bonds. Our expert team ensures:

• Guidance on eligibility and documentation

• Seamless application and allotment process

• Updates on the latest interest rates and availability

• End-to-end support for both physical and demat holding

Conclusion

Capital Gain Bonds are a safe and tax-efficient investment avenue for individuals and entities who have recently sold a property or any qualifying asset. With the dual advantage of tax savings and government-backed safety, they remain a top choice for prudent investors.

If you are planning to sell a property or have recently booked long-term capital gains, act within the 6-month window to maximize your tax benefits. A timely investment in 54EC Bonds can save you lakhs in taxes while offering stable returns.

Secure your future with the right strategy. Start your Capital Gain Bond investment journey today with RR Finance Services Pvt Ltd.

📞 Contact +919350316010 today and get expert assistance in making the most of your tax-saving opportunities.

🔗 You May Also Like

• SIP & Mutual Funds in 2025 – The Smart Way to Build Wealth in India

• Best Fixed Deposit Schemes in India

• How RBI Floating Rate Savings Bonds Are Better Than Fixed Deposits