In an increasingly digital world, remittances are evolving. One of the most innovative advancements is the rise of the voucher remittance platform. These platforms allow individuals to send funds or credits in the form of vouchers, which can be redeemed across various services. This method is especially significant in regions like Africa, where vouchers Africa has become a powerful tool for both personal and business transactions.

The Rise of Voucher Remittance Platforms

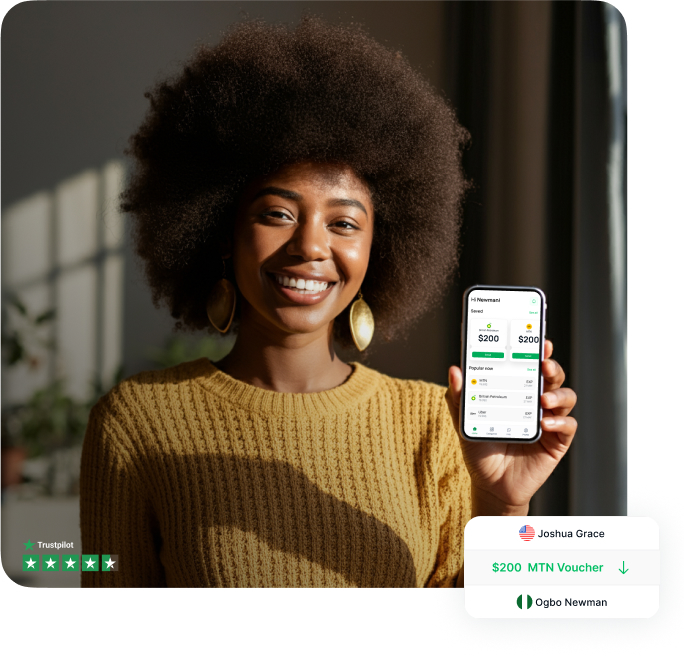

A voucher remittance platform offers a fast and secure alternative to traditional money transfer services. This digital solution enables users to send vouchers that can be used to purchase goods, pay bills, or even top up mobile phones. These platforms are particularly beneficial for individuals in areas with limited banking infrastructure, providing them with a means to access essential services without needing physical money. The simplicity and convenience of this method have driven its rapid adoption.

How Vouchers Are Changing Transactions in Africa

In Africa, vouchers Africa has emerged as a key method of financial transactions, especially in rural or underserved areas. Many countries in Africa face challenges such as limited access to banks or financial institutions. By using vouchers, individuals can transfer money and access services remotely without relying on physical cash. This provides a bridge for families and businesses to make transactions more efficiently, contributing to economic development and financial inclusion.

Advantages of Using Voucher Remittance Platforms

Using a voucher remittance platform offers several advantages over traditional bank transfers. These platforms often have lower fees and faster processing times and provide access to funds without the need for a bank account. In addition, they are accessible from mobile devices, making them convenient for users in remote locations. With digital vouchers, there is no need to worry about currency exchange or waiting for bank transactions to clear, which makes these platforms a more reliable solution.

Voucher Remittance and Security in Africa

Security is a major concern when it comes to sending and receiving money. Fortunately, voucher remittance platforms employ state-of-the-art encryption technology to ensure that transactions are safe and secure. The use of digital vouchers adds another layer of security since they cannot be easily forged or lost, unlike physical cash. This makes vouchers Africa a safer alternative for transferring funds, especially in regions where theft or fraud might be a concern.

Expanding Access to Services with Vouchers

By enabling transactions via vouchers Africa, these platforms are helping to improve access to essential services. Vouchers can be used to pay for utilities, healthcare, education, and more, especially in areas where traditional payment methods might be inaccessible. This growing accessibility is particularly impactful for rural communities or individuals without easy access to banking services, contributing to greater financial inclusion.

Conclusion

In conclusion, the rise of the voucher remittance platform and the use of vouchers Africa represent a transformative shift in how people send money and access services. These platforms make transactions easier, faster, and more secure, especially in regions where financial infrastructure is limited. For more information about digital remittance services and how they are changing financial landscapes, visit lipaworld.com, your reliable source for all things related to digital financial solutions.

Blog Source Url:-

https://lipaworld.blogspot.com/2025/04/exploring-voucher-remittance-platform.html