Market Overview 2025-2033

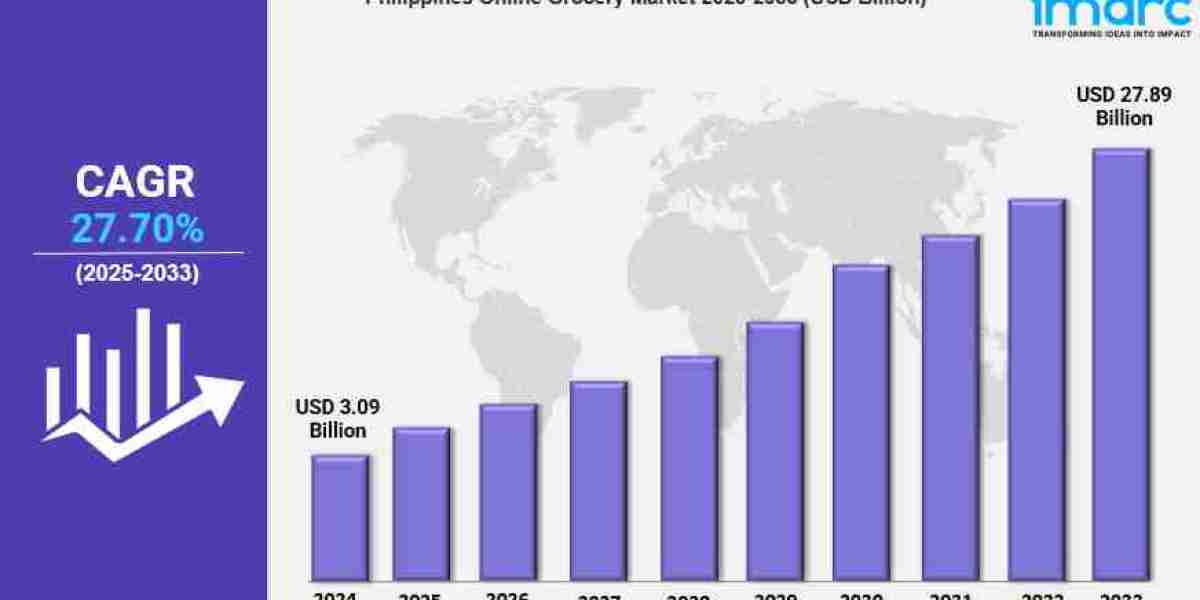

The Philippines online grocery market size reached USD 3.09 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.89 Billion by 2033, exhibiting a growth rate (CAGR) of 27.70% during 2025-2033. The Philippines online grocery market share is growing due to rising internet penetration, smartphone usage, and digital payments. Mobile-friendly platforms, fintech adoption, and cashless transactions enhance convenience. Government support, retailer investments, and secure payment systems drive e-commerce expansion.

Key Market Highlights:

✔️ Strong market expansion driven by digital adoption & urban lifestyle shifts

✔️ Increasing demand for fresh and premium grocery products online

✔️ Rising preference for sustainable and eco-friendly packaging solutions

Request for a sample copy of this report: https://www.imarcgroup.com/philippines-online-grocery-market/requestsample

Philippines Online Grocery Market Trends and Drivers:

The rapid digital transformation in the Philippines is significantly boosting the growth of the online grocery market, as more consumers embrace the convenience of digital shopping platforms. The increasing internet penetration, widespread use of smartphones, and the popularity of cashless transactions have made it easier for Filipinos to shift from traditional grocery shopping to online alternatives. By 2025, the demand for seamless, tech-driven grocery shopping experiences is expected to rise further, fueled by busy urban lifestyles and the need for convenience.

E-commerce giants, supermarket chains, and independent grocery retailers are continuously improving their digital presence, investing in user-friendly apps, AI-driven recommendations, and personalized shopping experiences. Additionally, enhanced digital payment solutions, including e-wallets and buy-now-pay-later (BNPL) services, are making online grocery shopping more accessible to a broader consumer base. As competition intensifies, companies are also focusing on improving last-mile delivery efficiency, offering express and same-day delivery services to meet evolving customer expectations.

Filipino consumers are becoming increasingly selective when it comes to their grocery purchases, with a rising preference for fresh, organic, and premium food products. The demand for high-quality fruits, vegetables, meat, and seafood is growing, as health-conscious individuals seek better dietary options. By 2025, the online grocery market is expected to see a surge in the availability of specialty and premium goods, including organic produce, plant-based alternatives, and imported gourmet items. E-commerce grocery platforms are responding by partnering with local farmers, suppliers, and international brands to offer a diverse selection of fresh and exclusive products.

Subscription-based grocery services and personalized meal-kit deliveries are also gaining traction, catering to busy professionals and families looking for convenience without compromising on quality. Furthermore, advanced cold chain logistics and improved packaging solutions are ensuring the freshness of perishable items, making online grocery shopping a more reliable and attractive option for consumers.

As environmental awareness grows, Filipino consumers are becoming more conscious of sustainable packaging choices when shopping for groceries online. The increasing concern over plastic waste and its impact on the environment has led to a demand for biodegradable, recyclable, and reusable packaging materials. By 2025, online grocery retailers are expected to prioritize eco-friendly packaging solutions, integrating paper-based wraps, compostable bags, and reusable containers to align with consumer preferences and regulatory guidelines. Supermarkets and e-commerce grocery platforms are also introducing sustainable initiatives, such as incentivized returns for reusable packaging and minimal-waste delivery options.

Additionally, the push for sustainability extends beyond packaging, as many retailers are sourcing ethically produced goods and promoting locally grown, organic products. With consumers actively supporting brands that align with their environmental values, online grocery businesses that adopt sustainable practices are likely to gain a competitive edge, fostering long-term customer loyalty and industry growth.

Philippines Online Grocery Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Philippines online grocery market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Product Type Insights:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Business Model Insights:

- Pure Marketplace

- Hybrid Marketplace

- Others

Platform Insights:

- Web-Based

- App-Based

Purchase Type Insights:

- One-Time

- Subscription

Regional Insights:

- Luzon

- Visayas

- Mindanao

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145