How GST Return Filing Impacts Your Tax Refunds, Compliance & Reputation

For any business operating in the Indian tax system, GST Return Filing is much more than a legal requirement - it is a key element of financial discipline and legitimacy. With the Indian GST system linking tax compliance to refund eligibility, vendor relationships, and reputation, GST Return Filing must be done accurately and on time. Whether you are a startup, an MSME or a large company, knowing how GST Returns Online effect your tax lifecycle can save you money, protect your business from penalties, and support your market position.

1. Tax Refunds Depend on Timely GST Return Filing

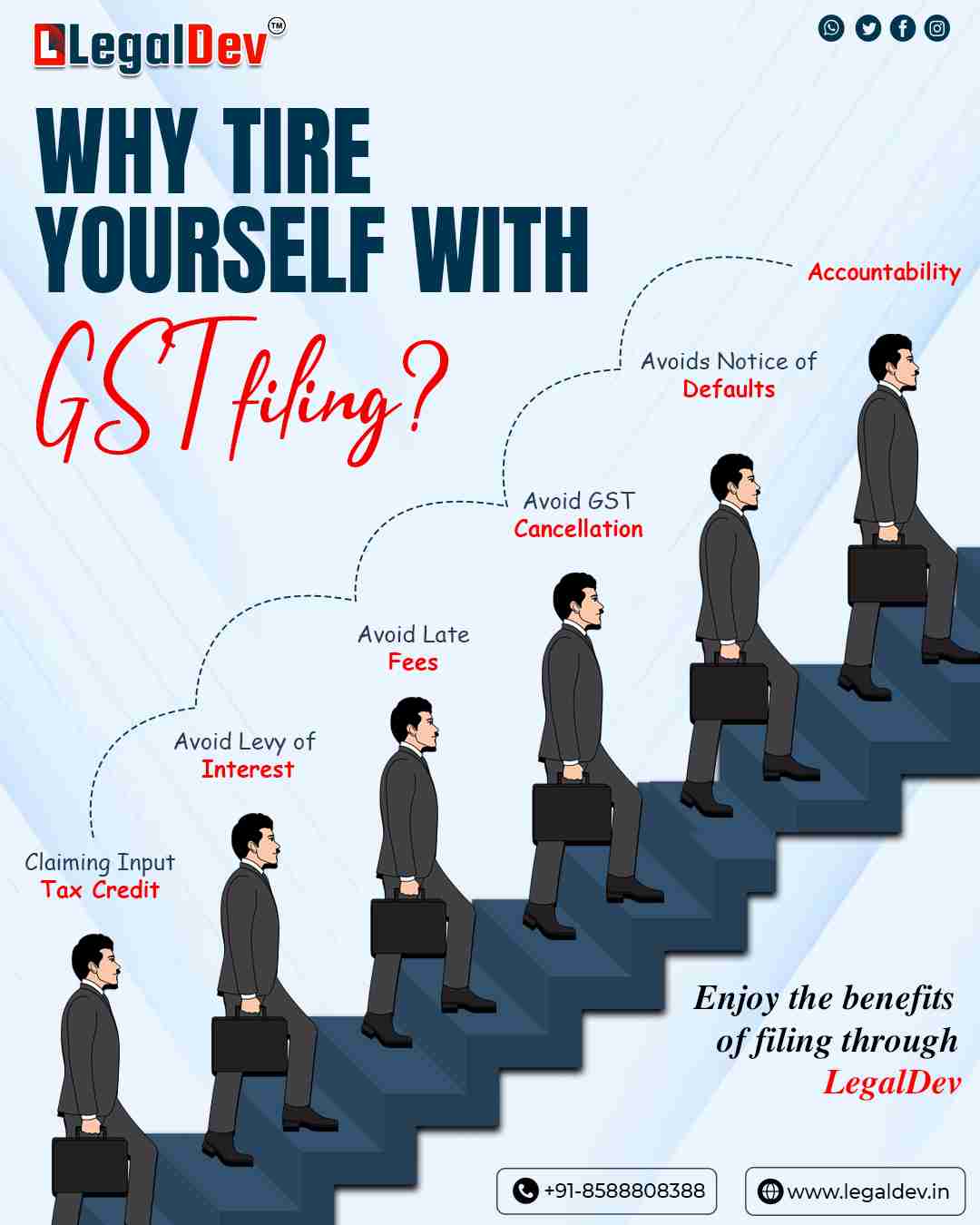

One of the major benefits experienced by businesses who consistently file GST returns is reliable Input Tax Credit (ITC) and time-sensitive tax refunds. GST law allows businesses to offset ITC from their purchases and offset it against their output tax obligation. However, both parties (in this case the supplier and recipient) are required to file their GST returns correctly and within the timeframes before ITC is accessible for either party's input on that product or service.

If either party does not submit their GST returns, even for just one month, the supplier's ability to refund will be limited and the recipient may not claim ITC on the product or service. Furthermore, even if the supplier and recipient filed their returns on time, reconciliation discrepancies found in the suppliers GSTR-1 and the recipient's GSTR-3B can cause disputes, rejected GST returns or an ITC that may have to be reversed. This is why businesses are quickly turning to Online GST Return Filing Services in India to avoid human error, reliance upon the other party's return, or when their tax filing obligation requires significant delays.

2. Compliant is easier with regular GST Return Filing

Continual changes to GST policy, rate increases, and e-invoicing evolve can create significant complexity to compliance. If your business does not file regularly, then your business is not compliant, and you could become liable for interest, late fees or penalties from the GST department. In the worst case, you could even find that your GSTIN is suspended for non-compliance and you are unable to generate e-way bills or invoice customers. This is why businesses are transitioning to Online GST Return Filing Services that includes continual updates and balances your compliance needs in real-time.

3. Your Reputation Depends on Your Compliance

Today, your business's GST compliance/governance is now a matter of public record. It's not great to have delayed or missed filings, and I'd imagine it would be worse if you did business with corporates or government departments. Many companies are now conducting vendor civil checks when registering vendors and release payments. A bad GST filing history may result in cancelled contracts and issues with respect to trust further down the supply chain.

In contrast, up to date GST return filing increases your vendor rating, gives you a chance for faster payments, and enhances your reputation in the ecosystem. GST compliance is becoming an indicator of financial discipline and operational maturity.

4. Why Businesses Choose Professional GST Return Filing Services in India

Properly filing GST returns is a confusing task for most business owners—it goes beyond merely uploading tax invoices. In fact, fully complying with GST involves reconciling input and output, reconciling your GSTR-2B, and checking for input tax credit mismatches while also keeping up to date related to compliance deadlines. For this reason, many SMEs and sizeable enterprises choose to rely on GST Return Filing Services in India to navigate all of this complexity. A dedicated resource team to keep that due date and cut down on the probability of errors, freeing up your time to focus on growing your business instead of filling out tax forms.

When you engage with a professional Online GST Return Filing Service you aren't just completing a filing requirement, you are purchasing peace of mind, accuracy and credibility with your stakeholders over the longer term.

Conclusion

GST Return Filing is not just a monthly or quarterly obligation. It is a vital function for tax refunds, legal compliance and brand reputation. Inconsistency and errors in your filing activity can hinder your ITC and could result in penalties and brand reputation damage in the marketplace. To be tax-smart, build a tax-smart business, and avoid the above-mentioned risks, consider switching to Online GST Return Filing Services in India. Whether you are simply testing your business model or growing toward a new expansion, engaging a professional will make a tangible difference in the efficiency of your return filing/tax compliance and clarity in your business approach to financial performance.

https://legaldev.in/GST-Return-Filing.aspx